No More Sticker Shock: Finding the Right Dental Payment Plan

Why Dental Care Costs Shouldn’t Keep You from Smiling

Dental payment plans help you afford necessary dental care by breaking down treatment costs into manageable monthly payments. Here are your main options:

Quick Overview of Payment Plan Types:

- In-House Financing – Payment plans offered directly by your dental practice, often interest-free with shorter terms (typically 3-12 months)

- Third-Party Financing – Healthcare credit cards like CareCredit or Cherry that offer longer terms (6-60 months) with promotional 0% APR periods

- Dental Discount Plans – Membership programs offering 20-50% discounts on treatments (not insurance or financing)

- Combined Approaches – Using insurance coverage plus financing for out-of-pocket costs, or pairing HSA/FSA accounts with payment plans

Most families waste hundreds of dollars each year by not understanding how their dental benefits actually work. Even worse, many people put off necessary dental care because they think they can’t afford it.

The reality is simpler than you might think. Whether you need a filling that costs $150-400 or a major procedure like implants that can run thousands, payment plans make dental care accessible by spreading costs over time. Over 80% of patients can be approved for zero-interest offers, and financing can cover up to $75,000 for treatments.

The sticker shock doesn’t have to stop you. Understanding your options means you can get the dental care you need now, not months or years from now when problems get worse and more expensive.

I’m Dr. Risha Khan, and I’ve spent the past decade helping patients steer dental payment plans to make quality care affordable for families in the Edmonds area. My goal is to ensure financial concerns never stand between you and a healthy smile.

Understanding Your Options: Types of Dental Payment Plans

Facing dental treatment costs can be overwhelming, but financial constraints shouldn’t be a barrier to a healthy smile. At Arista Dental Care of Edmonds, we offer and work with various dental payment plans to make your care affordable.

Understanding the different types of dental payment plans is the first step. We’ll explore the most common options to help you see how each can make your dental care accessible. For a broader look, you can visit CareCredit’s page on Dental Care Financing Options.

In-House (Internal) Financing

Sometimes, the simplest solution is right under our roof! Many dental practices, including ours, offer in-house dental payment plans. These are direct agreements between you and our practice, allowing you to pay for your treatment in installments.

How it works: Typically, you’ll make an initial down payment, and then the remaining balance is divided into manageable monthly payments. These plans are often designed for shorter terms, perhaps 3, 6, or 12 months, and are frequently interest-free.

Pros of In-House Financing:

- Simplicity: The application is straightforward and often based on your relationship with our practice.

- No Interest: Many plans are interest-free, so you only pay for your treatment.

- Flexibility: We can often tailor the schedule to your budget.

- Builds Trust: It strengthens the relationship between you and our team.

Cons of In-House Financing:

- Shorter Terms: Repayment periods are often shorter, which can mean higher monthly payments.

- Limited Amounts: There may be a cap on the total amount financed.

- Regulatory Considerations: Complex regulations can limit plans to shorter terms.

For many of our patients in Edmonds, Lynnwood, and the greater Seattle area, in-house financing provides a comfortable and convenient way to manage costs for treatments like fillings, crowns, or even smaller cosmetic procedures.

Third-Party Financing Companies

For extensive treatment or longer repayment terms, third-party financing companies like CareCredit or Cherry are a popular choice. They specialize in healthcare financing and act as a bridge to your dental needs.

How they work: You apply directly to the financing company, which then approves you for a credit line specifically for healthcare expenses. This isn’t a general credit card; it’s designed to cover medical and dental costs.

Key features of third-party financing:

- Healthcare Credit Cards: Options like CareCredit can be used for various healthcare services, not just dental.

- Longer-Term Loans: These plans offer longer repayment periods (6 to 60+ months), which lowers your monthly payment and makes major treatments more attainable.

- Promotional 0% APR Offers: Many plans offer a “no interest” period (e.g., 6, 12, or 24 months). If you pay the balance in full during this time, you avoid all interest.

- Deferred Interest Explained: It’s crucial to understand this term. If you don’t pay off the entire balance before the promotional period ends, interest is often retroactively applied to the original purchase amount, which can be a costly pitfall.

- Low-Interest Plans: Beyond promotional periods, many providers offer low-interest plans with fixed monthly payments.

- Credit Approval: Eligibility and terms depend on your creditworthiness. With over 80% of patients approved for zero-interest offers, these plans are highly accessible.

Third-party financing is an excellent solution for significant procedures like dental implants or orthodontics, allowing you to spread the cost over several years. To learn more, the American Dental Association offers helpful insights in their article, “Should I Use A Financing Plan To Pay For My Dental Care?“.

Dental Discount Plans vs. Financing

It’s important to distinguish between dental payment plans (financing) and dental discount plans. Both make care more affordable, but they function differently.

Dental Discount Plans:

- How they work: These are not insurance or a loan. You pay an annual membership fee to receive a set percentage discount (often 20%-50%) on treatments from participating dentists.

- Key characteristics:

- Membership Fees: You pay an annual fee to join.

- Percentage Discounts: You get a reduced price on services (e.g., 20%-50% off).

- Not Insurance: There are no claims, deductibles, annual maximums, or waiting periods. You pay the discounted rate at the time of service.

- No Annual Maximums: A big advantage for extensive work, as discounts aren’t capped.

- Pros: Immediate savings, no paperwork, no waiting periods, often covers cosmetic procedures not typically covered by insurance.

- Cons: Only applicable at participating dentists, you pay out-of-pocket at the time of service, requires an annual fee.

How they differ from a loan (financing): A discount plan reduces the upfront cost of treatment. A dental payment plan (financing) helps you pay that cost over time. You can combine them: use a discount plan to lower the total bill, then use financing to pay the remaining balance in installments.

For patients in the Edmonds, Shoreline, or Lynnwood areas without traditional dental insurance, or those needing extensive work that exceeds their insurance maximums, a dental discount plan can be a valuable tool in their financial planning for dental care.

Decoding the Fine Print: Key Terms and Legal Considerations

Understanding any financial agreement, especially for something as important as your health, is paramount. We want you to feel completely confident and informed about your dental payment plan. This means taking a close look at the terms and conditions.

Understanding Your Agreement

When considering a dental payment plan, it’s crucial to read the entire agreement. While not exciting, it’s vital for your financial well-being.

Key terms to scrutinize:

- Interest Rates (APR): The annual percentage rate you’ll pay. For third-party financing, this can range from 0% (promotional) up to 35.99%. Know the post-promotional APR.

- Promotional Periods: Many plans offer 0% APR for a set time (e.g., 6, 12, or 24 months). This is a great deal if you can pay the balance in full within that window.

- Deferred Interest Trap: Be aware of this. If you don’t pay the full balance by the end of a “no interest” promotional period, interest is often charged retroactively from the original purchase date, making the loan very costly.

- Credit Reporting: Most third-party financing reports to credit bureaus. On-time payments can help your credit, while missed payments will hurt it.

- Minimum Payments vs. Paying Off Balance: The minimum payment on a 0% APR plan may not be enough to clear the balance before interest kicks in. Calculate what you need to pay monthly to avoid interest.

- Total Cost of Financing: Consider the total amount you’ll pay over the life of the loan, including interest.

- Late Fees and Prepayment Penalties: Check for late fees (common) and prepayment penalties (less common).

- Your Rights as a Borrower: The Truth in Lending Act (TILA) ensures lenders disclose credit terms clearly. You can find more information on the Laws and Regulations on the Truth in Lending Act from the Consumer Financial Protection Bureau.

We encourage all our patients in Edmonds and the surrounding areas to ask questions! Our team is here to help clarify any part of the financial agreement. For more specific details about the financing options we offer, please visit our page on Dental Insurance and Financing Options.

Wise Tips for Using Dental Payment Plans

Using dental payment plans wisely means being proactive and informed. We want you to avoid any financial pitfalls and make the most of these valuable tools.

Here are our top tips:

- Only finance what you can afford: Assess your monthly budget to determine a comfortable payment amount. Don’t let the excitement of a new smile overshadow your financial reality.

- Pay on time and understand interest: For 0% APR offers, calculate the monthly payment needed to clear the balance before the promotional period ends. Set up automatic payments to avoid missing a due date.

- Understand the agreement: If anything is unclear, ask us. Keep copies of all documents for your records.

- Avoid the deferred interest trap: Make it your mission to pay off the full balance before the promotional period expires to avoid retroactive interest.

- Use online payment portals: Convenient online portals make it easy to manage payments and track your balance. You can use our Online Payment portal.

- Don’t overextend yourself: If financing all your dental work at once creates too much debt, talk to us about phasing your treatment based on urgency.

By following these guidelines, you can leverage dental payment plans to get the care you need without unwanted financial stress. We’re here to guide you through the process every step of the way.

Maximizing Your Benefits: Combining Insurance with Payment Plans

Navigating dental insurance can be a puzzle. The good news is that dental payment plans aren’t just for the uninsured; they are a powerful tool to complement your coverage and manage out-of-pocket costs.

Dental insurance often acts more like a discount plan than full coverage, with common limitations such as:

- Annual Maximums: Most plans cap benefits at $1,000-$2,000 per year, a figure that hasn’t changed much in decades. Higher maximums provide better value.

- Deductibles: The amount you pay before insurance coverage begins.

- Copayments/Coinsurance: The percentage of the cost you are responsible for.

- Waiting Periods: A 6-12 month wait may be required for major procedures.

This is where dental payment plans shine. They step in to cover the gaps, ensuring you don’t delay necessary treatment due to these insurance limitations.

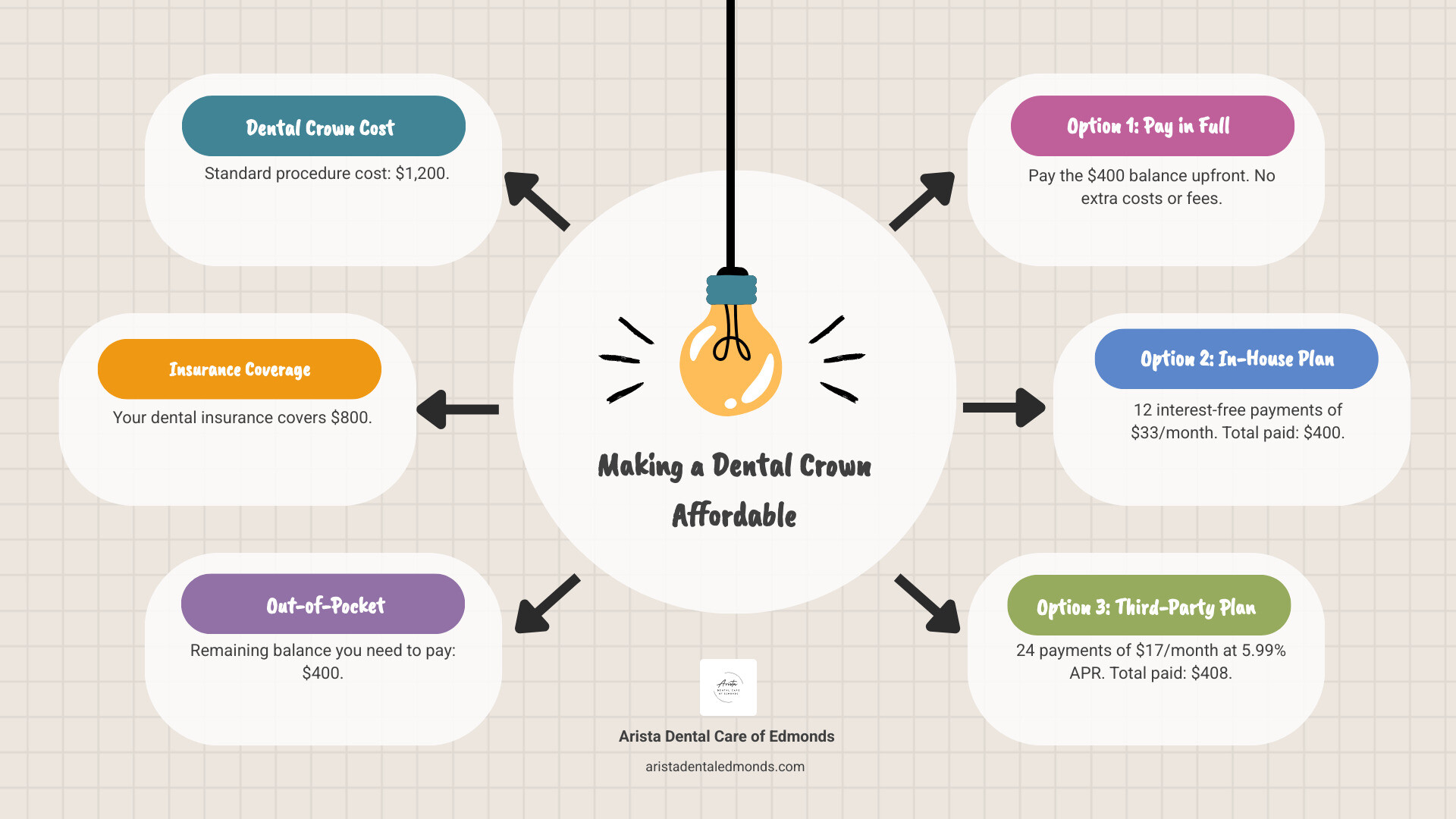

Strategic Use for Expensive Treatments

When it comes to major dental investments like implants or orthodontics, the total cost can quickly exceed your annual insurance maximum. This is a perfect scenario for strategically combining your insurance with a dental payment plan.

Here’s how it works:

- For Implants: Insurance may only cover a portion of a dental implant’s cost. A dental payment plan can finance the remaining balance over many months, making the treatment immediately affordable.

- For Orthodontics: Insurance often has a lifetime maximum for orthodontics. Financing can spread the remaining cost over time, creating manageable monthly payments.

- Splitting Costs Over Time: We can sometimes split expensive treatments across two calendar years. This lets you use two annual insurance maximums, reducing the amount you need to finance.

- Making Major Procedures Attainable: Financing makes treatments like dentures or full mouth restorations accessible by breaking the cost into manageable payments. This clear path to affordability can increase case acceptance by up to 30%.

- Significant Financing Amounts: Options are available to finance up to $75,000 for up to 144 months, with 0% interest or low-interest plans available on approved credit.

By pairing your insurance with a well-chosen dental payment plan, you can avoid delaying crucial treatments, which often leads to more extensive and expensive problems down the road. We can help you steer these options right here at our Edmonds office.

Using FSAs and HSAs with Your Plan

Flexible Spending Accounts (FSAs) and Health Savings Accounts (HSAs) are fantastic tools for managing healthcare costs, and they integrate seamlessly with dental payment plans. These accounts allow you to set aside pre-tax money specifically for medical and dental expenses, effectively giving you a discount on your care.

Flexible Spending Accounts (FSAs):

- Pre-Tax Dollars: Contributions are made before taxes, reducing your taxable income.

- “Use It or Lose It” Rule: Funds must typically be used within the plan year, making them ideal for planned dental expenses.

- Paying Off Plan Balances: Use FSA funds to make payments on your dental payment plan with tax-free money.

Health Savings Accounts (HSAs):

- Paired with High-Deductible Health Plans (HDHPs): Available to those with specific high-deductible health plans.

- Rolls Over and Can Be Invested: Unlike FSAs, HSA funds roll over and can be invested, growing tax-free.

- Paying Off Plan Balances: Use HSA funds to cover out-of-pocket costs or make payments on your dental payment plan.

- Triple Tax Advantage: Contributions are tax-deductible, earnings grow tax-free, and withdrawals for qualified medical expenses are tax-free.

Using an FSA or HSA can save you 20-30% on dental expenses. Combining these accounts with a dental payment plan is a highly efficient strategy. For example, use your HSA/FSA funds to pay down a financed balance, potentially reducing interest or clearing the debt before a promotional period ends.

Frequently Asked Questions about Dental Payment Plans

We understand that you might have more questions about dental payment plans. It’s a big decision, and we want to provide all the clarity you need. Here are some of the most common questions we hear from our patients in Edmonds, Shoreline, and the wider Puget Sound region.

Do dental payment plans affect my credit score?

Yes, especially third-party financing plans. Here’s how:

- Credit Inquiry: Applying for third-party financing typically involves a “hard inquiry,” which can temporarily lower your score. A simple in-house plan may not require a credit check.

- Reporting to Credit Bureaus: Most third-party financing companies report your account activity to major credit bureaus.

- Positive Impact: On-time payments can improve your credit score.

- Negative Impact: Late or missed payments will damage your credit score.

- Credit Utilization: Using a healthcare credit card can affect your credit utilization ratio. Keeping this ratio low is best for your score.

It’s always a good idea to understand the specific terms of your chosen dental payment plan regarding credit reporting before you commit.

Can I get a payment plan with bad credit?

Yes, but options vary by plan and provider.

- Third-Party Financing: Lenders often have options for a wide range of credit scores, though the best terms (like 0% APR) usually require good credit. Some providers approve over 80% of patients for zero-interest offers, while others may offer higher-interest plans for lower scores.

- In-House Plans: This is often a great option for those with poor credit. As the agreement is with our practice, we have more flexibility and can consider factors beyond just a credit score.

- Secured vs. Unsecured Options: Most dental financing is unsecured. However, in some rare cases, or for very large amounts, a secured loan might be an option, but this is less common in dental care.

If you’re concerned about your credit score, don’t hesitate to discuss your financial situation openly with our team. We’re here to explore all available options and help you find a solution that works for you. Your health is our priority, and we believe everyone deserves access to quality dental care.

What happens if I can’t make a payment?

If you find yourself unable to make a payment, the most important thing is to act quickly and communicate.

- Contact the Lender Immediately: Whether it’s our office or a third-party company, reach out as soon as you know there’s a problem. Proactive communication helps.

- Restructuring Options: Lenders may offer temporary forbearance (pausing payments), an adjusted payment schedule, or allow a partial payment.

- Late Fees: Most plans charge late fees for missed payments.

- Credit Score Impact: Missed or late payments are reported to credit bureaus and will negatively affect your score.

- Default: Consistently missed payments can lead to default, which has severe credit consequences and may lead to collections.

Our advice is always to prioritize open communication. We understand that financial challenges can arise, and our goal is to help you maintain your oral health while managing your financial obligations responsibly. Don’t let fear of a missed payment keep you from reaching out to us.

Conclusion: Invest in Your Smile with Confidence

We hope this guide has demystified dental payment plans and empowered you with the knowledge to make informed decisions about your dental health investments. No one should have to compromise their oral health due to financial concerns.

At Arista Dental Care of Edmonds, we firmly believe that dental payment plans are not just about financing; they’re about access to care, peace of mind, and the confidence that comes with a healthy, vibrant smile. They serve as essential tools, allowing you to receive the necessary treatments today, preventing small issues from becoming larger, more painful, and more expensive problems tomorrow.

Whether you’re exploring in-house options, considering third-party financing like CareCredit, or looking into dental discount plans, we’re here to help you steer every step. Our compassionate team is dedicated to providing comprehensive, gentle dental care for all ages, utilizing advanced technology to ensure comfortable visits. We serve families across Edmonds, Shoreline, Lynnwood, Mountlake Terrace, Seattle, and the wider Western Washington region.

Don’t let the fear of “sticker shock” hold you back from achieving the smile you deserve. Proactive dental health is an investment that pays dividends in comfort, confidence, and overall well-being.

Ready to discuss your treatment options and find the perfect dental payment plan for your needs? We invite you to connect with us. Let’s work together to ensure your smile journey is smooth, affordable, and stress-free.

Start your journey to a new smile today!

Edmonds Dentist

21727 76th Ave W Ste G, Edmonds, WA 98026

(425) 967-7272

info@aristadentaledmonds.com

Edmonds Dentist

21727 76th Ave W Ste G, Edmonds, WA 98026(425) 967-7272

info@aristadentaledmonds.com